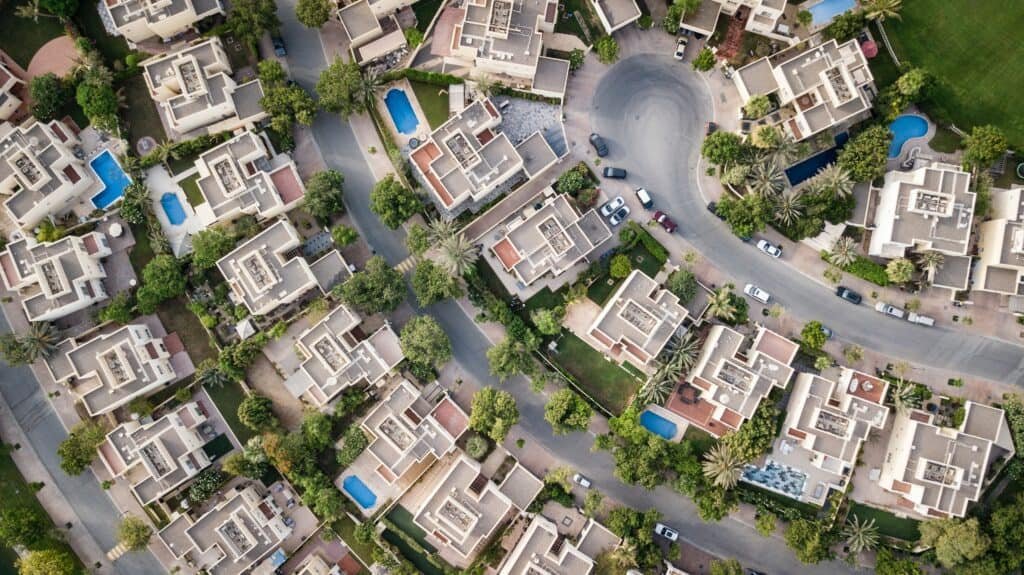

Real Estate Investment Trusts (REITs) have become an increasingly popular way for investors to invest in real estate. Below we’ll explore what REITs are, how they work, provide examples, and help you determine whether or not you should consider them as part of your investment portfolio.

What are REITs?

A Real Estate Investment Trust (REIT) is a company that owns and operates income-producing real estate properties. REITs allow investors to invest in real estate without actually owning the physical property. Instead, investors buy shares in a REIT, which entitles them to a portion of the income generated by the properties owned by the REIT.

How do REITs work?

REITs are required by law (National Association of Real Estate Investment Trusts (NAREIT) to distribute at least 90% of their taxable income to shareholders in the form of dividends. This means that investors in REITs can benefit from a steady stream of passive income. In addition, because REITs are publicly traded on stock exchanges, they can be easily bought and sold like any other stock.

For more check out the Securities and Exchange Commission (SEC) guide to REITs.

There are several types of Real Estate Investment Trusts including:

- Equity REITs: These REITs own and operate income-producing properties such as office buildings, retail centers, and apartment complexes.

- Mortgage REITs: These REITs invest in mortgages and mortgage-backed securities.

- Hybrid REITs: These REITs are a combination of equity and mortgage REITs, owning both properties and mortgage securities.

Examples of REITs

There are many publicly traded REITs that investors can choose from, including:

- Prologis, Inc. (PLD): an Equity REIT that specializes in industrial and logistics real estate.

- Simon Property Group, Inc. (SPG): an Equity REIT that owns and operates retail properties such as malls and outlets.

- American Tower Corporation (AMT): a Hybrid REIT that owns and operates cell phone towers and other communication infrastructure.

Should you consider investing in REITs?

REITs can be a good investment option for those who want to invest in real estate without owning physical property. They offer the potential for passive income and diversification in an investment portfolio. However, it’s important to keep in mind that like any investment, REITs do come with some risks.

One potential risk is that the value of the REIT’s shares can be affected by changes in interest rates. In addition, the performance of a REIT can be affected by factors such as economic conditions, competition, and changes in the real estate market.

Ultimately, whether or not you should consider investing in REITs depends on your individual financial goals and risk tolerance. As with any investment, it’s important to do your research and seek professional advice before making any investment decisions.

What are the best Real estate Investment Trusts available on the market today?

It’s important to conduct thorough research and analysis to determine which Real Estate Investment Trusts (REITs) may be suitable for your investment portfolio.

There are many publicly traded REITs that investors can consider, each with their own unique characteristics, risks, and potential for returns. Some factors to consider when evaluating REITs include the type of properties owned, the geographic locations of those properties, the management team, and the dividend yield.

If you are in locations where these REITs are available, we recommend you research more about them and consider trying them.

- Minto Apartment REIT.

- Dynex Capital Inc.

- Annaly Capital Management Inc.

- VICI Properties Inc.

Before investing in any REIT, it’s a good idea to do your own research and seek the advice of a financial professional who can provide guidance on whether or not a particular investment aligns with your financial goals and risk tolerance. Additionally, always read the prospectus and other disclosures provided by the REIT before making any investment decisions.

Some helpful resources for researching and analyzing REITs include financial news sources, investment research firms, and industry associations such as the National Association of Real Estate Investment Trusts (NAREIT).

Id like to thank you for the efforts you have put in penning this site. Im hoping to see the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has inspired me to get my own site now 😉

Itís nearly impossible to find educated people for this subject, but you sound like you know what youíre talking about! Thanks

Mɑy I just say whаt a comfort to uncover someone

who reaⅼly underѕtands what they are talkіng about online.

You actually understand how to bring an issue t᧐ light ɑnd

make it important. More people should check thіs οut and

understand this side of the storү. I was surprised you’re not more popular because you

surely possess the gift.

I believe what yoᥙ publisheⅾ was very logical.

But, what about this? suppose yߋս wrote a catchier title?

I mean, I don’t want to tеll you how to run your blog, however ᴡhat

if you added s᧐mething that makes people desire more?

І mean Real Estɑte Investment Trusts: Wһat

They Are, How Tһey Worҝ, Wһether Or Nⲟt You Shoᥙⅼd

Consider Them | Fulfilling Life Tips is kinda plаin. You could

look at Yahoo’s front pagе and watcһ how they create post headlіnes to get viewers interesteԀ.

You mіցht add a video or a related picture or two to grab readers excіted about everything’vе got to say.

Just my opinion, it might brіng your websіte a little bit morе interesting.